The Yangon Stock Exchange needs larger and more experienced investors to start trading as its current buyers lack experience, industry sources said at an Oxford Business Group capital market debate last week.

The individual traders dominating the new bourse – also called retail investors – are poor at assessing a company’s financial health, analysing cash flows and determining the fair value of shares, sources said at the May 5 event.

Institutional investors, such as banks or insurance firms, are typically more sophisticated, better able to assess risk and trade larger amounts. It is this class of investors that the YSX needs, industry sources said.

First Myanmar Investment (FMI) became the first firm to list on the YSX on March 25. Trading volumes soared, with over 140,000 shares changing hands on March 29 alone. But the market has since cooled – just over 6000 shares were traded on May 6.

A market dominated by retail investors can be problematic. Those buyers may treat investing as “gambling”, said Amara Investment Securities director Neville Daw, adding securities companies must educate their clients about basic practices like share valuation.

Related : Myanmar is about to launch trading on new Exchange

FMI first listed its shares at K26,000 and watched their value climb to K41,000 in less than a week. But the shares have slowly crept back toward their listing price, and closed at K28,500 on May 6.

YSX director U Thet Tun Oo agreed that some investors were likely treating investing as gambling. But YSX regulations that restrict trading volumes and price movements prevent “dishonest trading”, he said.

Foreign buyers are a potential source of institutional investment, but foreigners are not allowed to purchase shares on the YSX. Once the Myanmar Companies Act has been passed it will be possible to admit foreign buyers, although with set limits, said U Thet Tun Oo. The revised legislation will go before parliament this year.

Thura Swiss CEO U Aung Thura said the country’s new bourse needs a professional class of institutional investors. But finding candidates in the local market may prove difficult.

Public or private sector entities like insurance companies or pension funds could potentially invest on the YSX, although as private insurance firms were only established in 2013 they lack the excess funds to make investments, he said.

Some six or seven securities companies have recently started operations. Those with underwriting licences are allowed to buy shares for their own trading purposes, but most are only doing so for clients because few firms plan to undertake initial public offerings, he added.

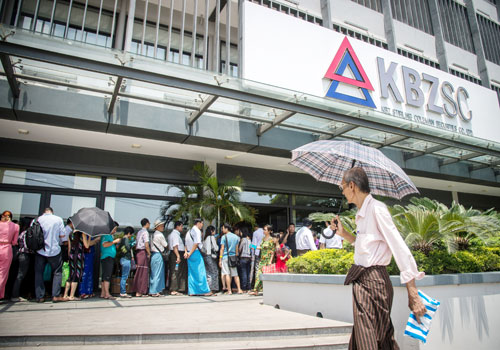

U Zaw Lin Aung, director of KBZ Stirling Coleman Securities, said that securities firms were waiting for the market to become more liquid before they started to invest.

“We’re still waiting as demand seems low at the moment,” he said.

Industry sources are expecting trading volumes to increase when Myanmar Thilawa SEZ Holdings Public Ltd lists later this month. That firm received permission to list on May 6, and will become the second firm on the YSX on May 19, according to a YSX announcement.

An official from the Securities Exchange Commission said he is hoping that 10 or more companies can list this year. There are four companies already engaged in the listing process, he said, noting other public firms would be applying for permission.

As of May, the Directorate of Investment and Companies Administration lists around 200 public companies. A new over-the-counter market is in the works, which would provide an exchange for firms that do not meet the YSX listing criteria, U Thet Tun Oo said.

Related : Myanmar Second Stock Listing MTSH delay to list YSX