Trading on Myanmar’s new exchange has launched, with only a single stock appearing on the board.

Trading on the Yangon Stock Exchange (YSX) opened March 25 with a single firm – First Myanmar Investment (FMI), a holding company operating in the financial services, real estate and health care sectors, debuting on the exchange.

FMI did not issue any new shares in its float, instead transferring its existing stock, which had previously been available through over-the-counter (OTC) trading, to digital accounts.

Early exchange fluctuations

Early trading in FMI’s shares saw a high degree of volatility, with strong gains in the first few days offset by subsequent declines. Having opened with a market capitalisation of MMK610bn ($515m), FMI saw its valuation rise to MMK845bn ($717m) before slipping somewhat on profit taking.

Ahead of the opening of trading, Serge Pun, chairman of FMI, said he was confident that, given time, the YSX would mature and develop.

“We are, in a way, fortunate being a late starter in developing a capital market, in that we can adopt the key success and avoid the failings of others in front of us,” he told regional media in March.

The development of Myanmar’s capital markets will offer alternative access to funding for companies, according to Linus Goh, head of global commercial banking and executive vice-president of Oversea-Chinese Banking Corporation.

“The establishment of the YSX will eventually offer equity-related or quasi-debt financing options, although its initial opening will be more symbolic than substantive in terms of offering a channel for Myanmar-based companies,” he told OBG earlier this year.

Read Also : Myanmar Second Stock Listing MTSH delay to list YSX

The YSX is 51% owned by the Myanmar Economic Bank (MEB) and 30.25% owned by Japan’s Daiwa Securities, with the remainder held by the Japan Exchange Group.

MEB and Daiwa are also partners in the country’s only other capital market, the Myanmar Securities Exchange Centre (MSEC), which was established in 1996. To date the MSEC has gained little traction, with just two equities listed. Expectations are higher for the YSX, however, with additional firms expected to list in the coming months.

More looking to be listed

A second firm, Myanmar Thilawa Special Economic Zone (SEZ) Holdings Public, a shareholder in the Thilawa SEZ, is set to list early in the second quarter. Like FMI, the company has said it does not intend to raise additional capital through its float, instead planning to transfer existing OTC shares onto the exchange.

Another four companies – First Private Bank, Great Hor Kham Public Company, Myanmar Agribusiness Public Corporation and Myanmar Citizens Bank – have been given approval to list, though none have set a date for their formal float.

If all four list, it will give the YSX a heavy emphasis on financial sector stocks, with half the companies from the financial services industry.

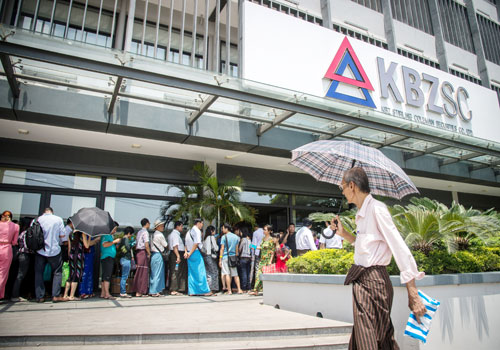

According to local media, Great Hor Kham Public Company may be the only firm looking to raise new funds through an initial public offering. The company has tentative plans to list in mid-2016, with licensed securities firm KBZ Stirling Coleman acting as underwriter.

Future IPO candidates

At the end of March the Securities and Exchange Commission of Myanmar (SECM) announced it is creating an OTC trading platform for companies on the path toward listing, helping promote a culture of equity investment and trading.

“New companies cannot enter the stock market as they don’t meet the criteria. They can sell their shares at the OTC market systematically,” Maung Maung Thein, chairman of the SECM, said following the launch of trading on the YSX.

Prior to the creation of the exchange, some 60 companies’ shares were traded OTC, including most of those planning to list on the exchange in the first round.

Not only is the commission laying the groundwork for new listings, but licensed underwriters are also probing the market for potential IPO candidates.

AYA Trust Securities, one of 10 firms approved by regulators to provide underwriting services on the exchange, is in talks with eight companies regarding possible listings, David Soe Lin, managing director of AYA Trust, said in early March.

“As it is a very thorough process, we will work together with our partner firms who have experience of stock markets in their own countries,” he said, adding it could be eight to 12 months before any of the firms were ready to list, as all regulatory requirements had to be met.

The boards could get more crowded still in 2017, making the YSX more representative of Myanmar’s expanding economy.

Reference : Myanmar Business Today

Read Also : Sino-Japan and Myanmar’s SEZ